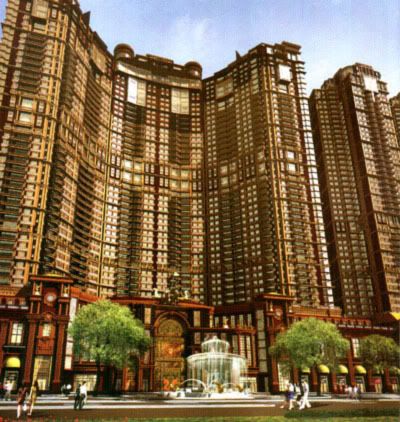

Address : Nam Van Lake, Quarteirao 12, Lote A, Macau

No. of units : about 461

No. of floors : 29

Area : Ranging from 1300 ft to 2500 ft

Facilities : Swimming pool, gym, cinema, function room, cigar room, wine lounge, table tennis room and activity rooms etc.

Completion Date : 2008

物業名稱: 湖畔名門

地點: 澳門南灣A12地段

物業層數 : 29層 (2樓-29樓為住宅單位)

物業樓底: 3米

單位總數: 約461個

建築面積: 1300呎-2500呎

物業設施: 天台空中花園, 有入戶花園及車房

物業景觀: 湖景、海景、橋景、觀光塔、主教山

預計完工日期: 游泳池, 健身室, 動感電影院, 宴會廳, 雪茄室, 紅酒室, 乒乓球室, 活動室等

Tuesday, December 22, 2009

[Under Construction] L’Hermitage 湖畔名門 (湖畔名门) 29F

Posted by seemacau at 12:52 AM 1 comments

Labels: SJM

Thursday, December 17, 2009

[Property News] Jones Lang LaSalle: A Strong Rebound in Macau’s Residential Market in 2H09 amidst Lower Interest Rates and Improved Economy

With the completion of the Chief Executive election and the listing of Sands China and Wynn Macau on Hong Kong Stock Exchange, Macau’s economic and political environment showed signs of improvement. Coupled with low interest rates, a high level of global liquidity, stock market rally and the beneficial mortgage and loan schemes, the investment sentiment was strengthened in 2H09 that resulted in an increasing number of residential property transactions and an uptrend of capital values in 2009 as a whole, according to Jones Lang LaSalle in its Macau Annual Property Review today.

Macau’s GDP recorded negative growth for the first two quarters but returned to positive regime in 3Q09, up 8.2% y-o-y. For the first three quarters as a whole, it still fell 6.8%. For private consumption expenditure, it declined by 0.5% y-o-y for the first three quarters following the negative growth of 1.2% y-o-y in 3Q09. Fixed capital formation decreased by 35% y-o-y for the first three quarters, partly due to the suspension of construction projects on Cotai Strip.

Gaming revenue experienced a turnaround in 3Q09 after reaching its record high of MOP 32 billion for a single quarter, with a growth of 22.2% y-o-y. However for the first three quarters as a whole, total gaming revenue still recorded a drop of 1.8% y-o-y. Entering October, gaming revenue continued to rebound and reached another record monthly high of MOP 12.7 billion. For the year to end-October 2009, Macau’s total gaming revenue reached MOP 96.6 billion, up 2.3% y-o-y.

For the tourist sector, total visitor arrivals fell by 7.1% y-o-y to 17.8 million for the first 10 months. However, it is worth noting that the y-o-y decline slowed from 11.4% y-o-y in 1H09 to 0.2% y-o-y for the period from July to October.

‘Thanks to the clearer picture of the global economy, Macau's gaming sector has regained its momentum and returned to the positive growth track since 3Q09, with new hotels and casinos opening in the city. This trend is expected to extend into 2010. With all these favourable factors in place, we can expect to see a more prosperous and healthy economy in Macau next year, lending support to the growth of the city’s property market,’ remarks Marcos Chan, Jones Lang LaSalle’s Head of Research, Greater Pearl River Delta.

Residential

Macau’s residential market has regained its growth momentum since 2Q09 when the global economy started to recover. Demand for residential properties strengthened with a dramatic pick-up in transaction volume from May onwards. The number of residential transactions returned to the pre-crisis level of over 1,000 transactions per month during the period from June to October. As of end-October 2009, a total of 7,944 residential transactions were recorded for the year-to-date, down 38.7% y-o-y.

For the mass–to-medium residential market, with the announcement of the 4%-interest rate subsidy scheme and mortgage guarantee programme by the government in 2Q09, purchasing demand strengthened significantly. As of December 2009, the government had approved 2,016 applications under the 4%-interest rate subsidy scheme and 1,471 applications under the mortgage guarantee programme. Since then, double-digit capital value growth was observed in the mass-to-medium residential market, bringing the full-year growth to 42.5%. Indeed, capital value growth was even higher in some of the newer schemes where demand is particularly strong.

On the leasing side of the mass-to-medium market, demand increased as some expatriates relocating to lower tier properties to reflect the contracted housing budgets. In 2009, mass-to-medium residential rents rose by 5.5%.

The high-end residential sector was less benefited by the government’s newly announced incentive measures as they were mainly designed for mass residential properties. On a higher base of comparison, high-end residential capital values grew by 21.9% in 2009. The leasing sector remained subdued as the number of expatriates in Macau continued to reduce. High-end residential rents remained stable after the dramatic falls in 4Q08 and1Q09, however, the completion and handover of One Central Residences has created some pressure on rents due to the increase in leasing stock. For 2009 as a whole, rents for high-end residential properties dropped by 12.6%.

‘While there is no indication whether the government will extend the subsidy schemes upon their expiry in June 2010, we observed that local purchasing power has been strengthened due to the government’s incentive policies. The number of local buyers for residential transactions in 2009 was on the rise and we expect this trend to continue in the near future,’ remarks Jeff Wong, Jones Lang LaSalle’s Head of Residential in Macau.

Several new projects were launched in 2009, such as Celebrity Lodge, Grand Eurheight, The Residencia Macau, Verde I & II, and One Central Residences. All of them were well received by the market. For the three years to 2012, there will be a total of 7,715 residential units entering the market. However, many of the newly completed units, estimated to be around 70%, have been pre-sold during their construction period. Thus, the effective number of new units available for sale is reduced to about 2,300 units.

‘Though there are risks of interest rate hike towards 2H10, ultimate holding costs will likely remain low and banks will remain positive towards mortgage lending. The mass residential sales market may slow down a bit as buyers will become more cautious after the strong run-up in prices in 2009. However, prices will remain stable as new units available for sale will remain relatively tight in 2010. For the luxury segment, the growing interest on Macau properties among the high net worth individuals from mainland China, coupled with the high level of liquidity and a gradual economic recovery, we expect there to be further room for capital value growth in 2010,’ concludes Wong.

Office

The year of 2009 saw Macau’s office market consolidate, with companies giving a high priority to cost savings. The majority of activities were for relocations to more cost-effective spaces, with expansion requirements not notably seen.

Having suffered from a slow momentum, office capital values and rents declined by 9.5% y-o-y and 12.9% y-o-y respectively in 2009.

‘Macau’s economy is expected to see a gradual improvement in 2010 with some of the suspended projects on Cotai Strip resuming their construction works and the construction of Hong Kong-Zhuhai-Macau Bridge moving onto track. It is not surprising to see demand for office space growing in 2010. However, companies’ expansion pace is expected to be slow at this initial stage of economic recovery. To look on the brighter side, the tight office supply will continue to lend support to Macau’s office rents,’ comments Gregory Ku, Jones Lang LaSalle’s Managing Director in Macau.

Investment

The year of 2009 saw foreign investors holding a wait-and-see attitude towards investment in Macau’s property market. Instead, local investors were relatively active, with properties in the four largest investment transactions during the year being purchased by the locals, fetching a total of about HKD 1.5 billion.

‘Hopefully with the reactivation of some of the suspended construction projects on Cotai Strip and on the back of a gradual global economic recovery, Macau’s property investment market will see a healthy growth in the coming year,’ says Ku.

Posted by seemacau at 1:00 AM 1 comments

Saturday, October 24, 2009

[Property News] Mace to deliver Macau's first green residential development

Mace Group has won a project management appointment on a luxury residential development for client Guia Hill (Macau) Investments Limited, a joint venture between Macquarie Real Estate and VC Group. This follows an appointment to carry out a due diligence report of the project site and demonstrates Mace Group's continued work in the region.

The US$32m scheme comprises 30 luxury apartments over six storeys and a mix of public and private space on the roof including pools and landscaped decking. Car parking will be provided at basement and ground level. The client aims to delivery luxury to an international standard and the building has also been designed to the highest environmental standards such that it will be eligible for gold standard accreditation for its 'green' credentials. If successful, Guia Hill will be the first residential project in Macau to receive formal environmental accreditation reflecting the increased awareness of sustainability issues amongst its target market of mainland Chinese.

As project manager, Mace is responsible for the procurement and management of the consultant team, developing and managing the master programme, managing the design, procurement of the works and management of the construction process until handover. Work got underway in October 2009 and is due for completion in early 2011.

This role follows a previous appointment to carry out a due diligence report of the project site.

Macau Peninsula is a special administrative region (SAR) of China, approx 60km west of Hong Kong and Mace secured the role thanks to its local knowledge gained in the successful delivery of the Venetian resort and casino and other major projects in the region.

Posted by seemacau at 1:07 AM 0 comments

Monday, October 12, 2009

[Under Construction] 晶品 The Verde - 7F

物業名稱: 晶品 The Verde

地點: 澳門新橋青草街

物業層數 : 7層

單位總數: 68個

物業間隔: 1房1廳及2房1廳連裝修精品公寓單位

建築面積: 500呎至1000呎

物業設施: 天台空中花園, 有入戶花園及車房

預計完工日期: 2010年10月

Posted by seemacau at 8:50 AM 0 comments

Saturday, August 29, 2009

Windsor Arch announce $2.1billion financing package for the project 澳門名門世家項目貸款21億 (澳门名门世家项目贷款21億)

Pics Source : Tanrich Property

The Windsor Arch recently took a major step forward with the securing of project financing. A number of major banks in Macau including the Bank of China (Macau), ICBC Bank (Macau), ICBC Bank (Asia), Wing Hang Bank, Tai Fung Bank, Macau BCM Bank and Bank of Communications will provided a total of $2.1 billion financing package for the development of the project.

Located at Taipa, Windsor Arch will consist of 10 apartment towers within the complex. The first phase of the project is scheduled to complete in 2012, while the second and third phase constructions will begin next year.

七家澳門及香港銀行與新建業旗下房地產發展公司 - 威得利企業發展股份有限公司簽署三年期, 貸款額達21億銀團貸款用作發展“名門世家”商住項目。 是次銀團貸款是近年澳門非博彩娛樂類中最大的, 並獲銀行超額認購。 貸款由中國銀行澳門分行、中國工商銀行(澳門)牽頭, 其他參貸行包括中國工商銀行(亞洲)、永亨銀行、大豐銀行、商業銀行及交通銀行。賬務代理行為中國銀行澳門分行, 押品代理行為中國工商銀行(澳門)。

三年期合共21億貸款分成兩部分, 一部分用作現有短期貸款的再融資, 第二部分為“名門世家”第一期開發費用。

澳門大型焦點新盤“名門世家”座落氹仔, 面向澳門賽馬場, 可眺望金光大道和旅遊塔。 由10座樓高47層的物業組成, 合共提供1512伙(標準戶面積介乎860至2,090方呎, 複式戶面積約3,500方呎, 另提供19間位於物業頂層的別墅)。 項目以歐洲建築風格, 以及提供傳統英式服務為特色, 而且建有名為「尊戶」雙會所、雙泳池等設施, 更有到戶式管家服務。 首期預計2012年首季入伙, 第二、三期可望明年動工。

Posted by seemacau at 11:35 PM 0 comments

Monday, August 17, 2009

Sky Palace Duplex at La Cite 寰宇天下海景天際獨立屋 - 「天池」首度曝光 (寰宇天下海景天际独立屋 - 「天池」首度曝光)

Sky Palace Duplex - located on 46/F and 47/F of La Cite.

位於澳門東方明珠區的豪宅項目「寰宇天下」頂層海景天際獨立屋「天池」首度曝光, 「天池」是全澳門首創私家天際泳池的特色府邸。 發展商早前於美國拉斯維加斯招標出售。 另外一個天際獨立屋「天籟」意向呎價, 發展商則暫未公布。

「天池」集最上乘的設備配料及巧手建築設計。 6房連4套房設計, 單位面積逾8,200方呎。 設有全澳門首個空中私人泳池。 全屋採用落地大玻璃設計。 客飯廳樓底高達20呎, 特設玻璃天幕可觀賞星空夜景。 室內設備包括價值逾百萬元之德國Varenna Poliform廚櫃組合, 配合Gaggenau廚房電器設備及美國SUB-ZERO牌雪櫃。 浴室除品牌配套外, 並設置三星LCD電視機。 其他設備包括智能家居系統, 遙控屋內燈光、音響及空調, 酒店式電梯大堂。 獨立屋擁千餘呎空中花園, 居高臨下俯瞰澳氹海景及澳門市全景。

Posted by seemacau at 1:47 AM 1 comments

Monday, March 30, 2009

[Under Construction] 聚賢雅苑 (聚贤雅苑) - The Celebrity Lodge 30F

物業名稱: 聚賢雅苑

地址 : 澳門連勝馬路110至112號

物業層數 : 30層

單位總數: 46個

建築面積: 1332方呎 - 1375方呎

預計完工日期: 2010

Posted by seemacau at 2:40 PM 0 comments

Sunday, March 29, 2009

[Under Construction] 東方麗都 (东方丽都) 35F

物業名稱: 東方麗都

地址 : 澳門罅些喇提督大馬路

物業層數 : 35層

單位總數: 120個

物業間隔: 3房2廳設計

建築面積: 採3梯4伙設計, 每層分ABC及D室, 最小單位為A室(面積1,538方呎), 最大單位為D室(面積1,686方呎)

物業設施 : 內設兒童遊樂區、遊樂設施及健身設備

預計完工日期: 2009

Posted by seemacau at 4:49 AM 0 comments

Tuesday, February 10, 2009

[Under Construction] 四季酒店服務式星級住宅 (四季酒店服务式星级住宅) - Four Seasons Private Apartment 40F

Pic Source : aedas.com

Pic Source : bigphilip

這類單位不作公開發售

物業名稱: 四季酒店服務式星級住宅

地址 : 澳門路氹金光大道

物業層數 : 40層

單位總數: 360個

建築面積: 由1980呎 - 3315呎

預計完工日期: 2009

Name : Four Seasons Private Apartment

Number of Units : 360

Expect to complete this project in the third quarter of 2009

The expected cost to complete the construction of the Four Seasons Private Apartments, including furniture, fixtures and equipment and preopening costs, is approximately $463 million.

Posted by seemacau at 11:32 PM 0 comments