物業名稱: 金峰南岸

地點: 澳門南岸地段石排灣馬路聯生填海區

發展商 : 新成功建築工程有限公司

物業層數 : 合共5座,每座樓高30層

單位總數: 4000多個豪宅單位和80幢別墅

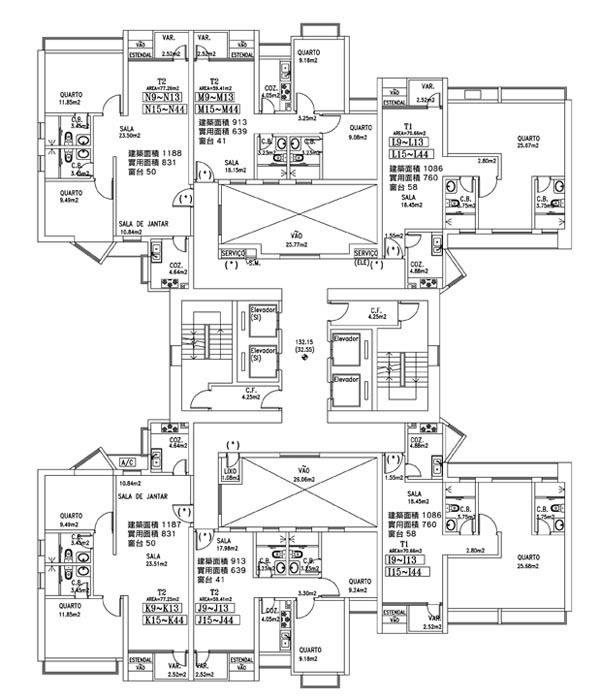

建築面積: 第一,二座呎數間隔相同 - 3F-24F 約1700-2000呎 (8伙), 25F 以上為特色單位。 第三,四,五座呎數間隔相同 - 3F-21F 約 600-1300呎 (10伙), 22F 約1100-1300呎(8伙), 23F 1200-1400呎(6伙), 24F - 30F為特色單位

物業設施: 豪華住宅、別墅、綜合商場、5星級酒店、5層頂級會所(合共70多項會所設施)、提供六星級酒店式物業管理服務

物業景觀: 凱撒高爾夫球場、橫琴澳門大學、媽祖、石排灣、金光大道(威尼斯人及新濠天地四季酒店)、澳門蛋、未來開幕的國際級娛樂中心等, 金光大道附近,旁邊有5000萬平方呎的綠化區,鄰近罕有的高爾夫球場

Tuesday, March 30, 2010

[Under Construction] One Oasis Cotai South 金峰南岸 5x30F

Posted by seemacau at 1:14 PM 10 comments

[Completed] The Riviera Macau - 凱泉灣

物業名稱: 凱泉灣

地點: 澳門河邊新街

發展商 : 何泉記建置業有限公司

單位總數: 約518個

物業間隔: 2房1廳, 3房1廳

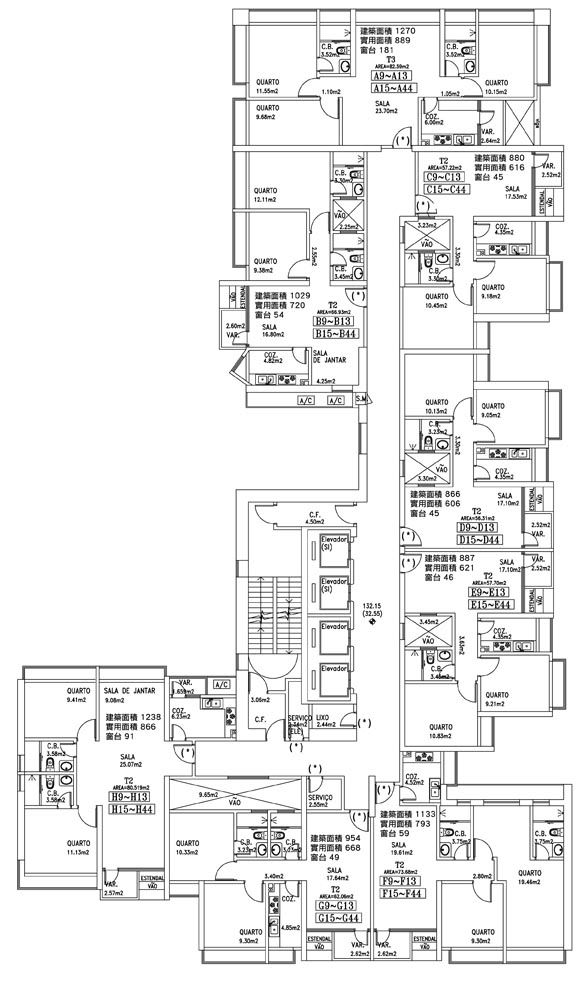

建築面積: 866 及 1270平方呎

物業設施: 泳池,桌球室,麻雀房等

物業景觀: 灣仔海景、西望洋主教山、澳氹大橋、氹仔、西灣橋、珠海、南灣湖、高層單位部份可望澳門半島全景

Posted by seemacau at 1:25 AM 0 comments

Friday, January 8, 2010

[Under Construction] 提督半島 32F

物業名稱: 提督半島

地點: 澳門提督馬路18-20號

發展商 : 新成功建築工程有限公司

物業層數 : 32層

物業間隔: 3房1廳

建築面積: A座 - 2088呎 / B座 - 2268呎

物業設施: 高級會所

Posted by seemacau at 10:57 PM 0 comments

[Under Construction] 合富188 - Richlink 188 Noble Court

物業名稱: 合富188

地點: 澳門慕拉士大馬路188號

物業設施: 近千尺超大空中庭園

物業景觀: 西南面毗鄰望廈山、螺絲山及東望洋山三山環抱, 坐擁20萬平方米自然生態, 匯集都市原生態自然資源於一身。 南望筷子箕灣、新葡京, 友誼大橋, 北望珠海拱北關閘, 珠江入海口。

Posted by seemacau at 10:48 PM 0 comments

[Property News] Cotai work to lift luxury home prices

Macau luxury properties could play catch-up with price rises elsewhere in the region in the New Year, driven by a confidence-boosting resumption of work on its Cotai mega-resort and a fresh influx of expatriate construction and casino staff.

"The top end of the property market in Macau has lagged the recovery in Hong Kong and could be in line for about 30 per cent growth in prices this year to an average of HK$9,000 per square foot from the current HK$7,000," said Ronald Cheung Yat-fai, the chief executive of Midland Realty (Macau).

"The economy here will certainly get a big boost if Las Vegas Sands resumes work on its resort development on the Cotai Strip, and the property market will benefit."

Cheung is referring to Sands China's widely expected resumption of construction work in the first half this year on its 6,000-room Cotai mega-resort across the street from its 3,000-room Venetian Macao. Sands China is the Hong Kong-listed arm of New York-listed parent Las Vegas Sands Corp.

In a move that hammered the group's New York share price and sentiment in Macau, work on the resort was suspended in November 2008 to help preserve cash and raise money for projects under way in Singapore and Pennsylvania.

To date, prices of top-end properties in the gambling enclave have not yet fully recovered from the blow. But estate agents say the resumption of work on the latest mega-resort in the gambling enclave, along with the start of construction last month on the Hong Kong-Zhuhai-Macau bridge - which will halve travelling time between Hong Kong and Macau to 30 minutes - will entice investors back into the market.

Signs of a revival are already evident, according to Cheung.

Units on upper floors of Macau's prestigious housing project, One Central Residences that offers sea views, are selling for HK$6,500 to HK$6,800 per sq ft, from a low of HK$3,700 in January last year after the added blow to confidence caused by the global financial crisis.

But compared with the average price of HK$20,000 per sq ft fetched by Hong Kong luxury flats, there remained ample room for further price gains, said Cheung.

He said luxury home prices in the enclave remained 30 per cent below their HK$10,000 per sq ft peak reached in 2007.

Patrick Wong, the chief executive of Tenacity Real Estate Group, which owns an office-retail project at 39 Avenida Alemida Riberio in the core business district of Macau, said: "Lots of banks are looking for office space for expansion and this is signalling that Macau's economy is improving."

Ma Iao Iao, the chairman of San Kin Wa Construction and Investment, a major developer in Macau, is also bullish about the market's prospect.

The firm plans to release the remaining units in its Bay View residential development, about 10 minutes' walk from the Macau ferry pier, for pre-sale early this year.

Ma believes Hong Kong buying interest will return to bet on the capital appreciation as the construction of the Hong Kong-Zhuhai-Macau bridge has started. The link will greatly improve Macau's accessibility when the bridge is completed by 2016.

He hopes the upcoming sale of Bay View, a medium-priced residential development due to be completed in June, will achieve a price of HK$3,000 per sq ft, about 7 per cent higher than current secondary market deals.

Gregory Ku, the managing director of Jones Lang LaSalle Macau, expects the market will continue to be dominated by domestic demand. He sees steady growth in deal volumes in the mass residential market driven by upgrader demand as salaries rise.

Ku first invested in Macau property in late 2004 when he bought a unit in the Kingsville development for HK$3 million. He resold that for a 30 per cent profit and bought another unit for HK$4 million in 2005 that he sold for HK$5 million in the same year.

But other estate agents say Macau mass-market prices have already rallied significantly, in particular units worth HK$1 million to HK$2 million each, mainly because of the government introducing mortgage subsidy and loan guarantee schemes.

Under the scheme introduced in the second quarter of last year, Macau permanent residents aged at least 21 years old who had not bought a property in the past three years qualified for a 4 per cent home loan interest rate subsidy scheme.

That helped fuel a 40 per cent rise in prices of mass- to medium-level housing, said the agents, who expect prices to remain broadly unchanged from present levels this year.

Posted by seemacau at 2:13 AM 10 comments

Tuesday, December 22, 2009

[Under Construction] L’Hermitage 湖畔名門 (湖畔名门) 29F

Address : Nam Van Lake, Quarteirao 12, Lote A, Macau

No. of units : about 461

No. of floors : 29

Area : Ranging from 1300 ft to 2500 ft

Facilities : Swimming pool, gym, cinema, function room, cigar room, wine lounge, table tennis room and activity rooms etc.

Completion Date : 2008

物業名稱: 湖畔名門

地點: 澳門南灣A12地段

物業層數 : 29層 (2樓-29樓為住宅單位)

物業樓底: 3米

單位總數: 約461個

建築面積: 1300呎-2500呎

物業設施: 天台空中花園, 有入戶花園及車房

物業景觀: 湖景、海景、橋景、觀光塔、主教山

預計完工日期: 游泳池, 健身室, 動感電影院, 宴會廳, 雪茄室, 紅酒室, 乒乓球室, 活動室等

Posted by seemacau at 12:52 AM 1 comments

Labels: SJM

Thursday, December 17, 2009

[Property News] Jones Lang LaSalle: A Strong Rebound in Macau’s Residential Market in 2H09 amidst Lower Interest Rates and Improved Economy

With the completion of the Chief Executive election and the listing of Sands China and Wynn Macau on Hong Kong Stock Exchange, Macau’s economic and political environment showed signs of improvement. Coupled with low interest rates, a high level of global liquidity, stock market rally and the beneficial mortgage and loan schemes, the investment sentiment was strengthened in 2H09 that resulted in an increasing number of residential property transactions and an uptrend of capital values in 2009 as a whole, according to Jones Lang LaSalle in its Macau Annual Property Review today.

Macau’s GDP recorded negative growth for the first two quarters but returned to positive regime in 3Q09, up 8.2% y-o-y. For the first three quarters as a whole, it still fell 6.8%. For private consumption expenditure, it declined by 0.5% y-o-y for the first three quarters following the negative growth of 1.2% y-o-y in 3Q09. Fixed capital formation decreased by 35% y-o-y for the first three quarters, partly due to the suspension of construction projects on Cotai Strip.

Gaming revenue experienced a turnaround in 3Q09 after reaching its record high of MOP 32 billion for a single quarter, with a growth of 22.2% y-o-y. However for the first three quarters as a whole, total gaming revenue still recorded a drop of 1.8% y-o-y. Entering October, gaming revenue continued to rebound and reached another record monthly high of MOP 12.7 billion. For the year to end-October 2009, Macau’s total gaming revenue reached MOP 96.6 billion, up 2.3% y-o-y.

For the tourist sector, total visitor arrivals fell by 7.1% y-o-y to 17.8 million for the first 10 months. However, it is worth noting that the y-o-y decline slowed from 11.4% y-o-y in 1H09 to 0.2% y-o-y for the period from July to October.

‘Thanks to the clearer picture of the global economy, Macau's gaming sector has regained its momentum and returned to the positive growth track since 3Q09, with new hotels and casinos opening in the city. This trend is expected to extend into 2010. With all these favourable factors in place, we can expect to see a more prosperous and healthy economy in Macau next year, lending support to the growth of the city’s property market,’ remarks Marcos Chan, Jones Lang LaSalle’s Head of Research, Greater Pearl River Delta.

Residential

Macau’s residential market has regained its growth momentum since 2Q09 when the global economy started to recover. Demand for residential properties strengthened with a dramatic pick-up in transaction volume from May onwards. The number of residential transactions returned to the pre-crisis level of over 1,000 transactions per month during the period from June to October. As of end-October 2009, a total of 7,944 residential transactions were recorded for the year-to-date, down 38.7% y-o-y.

For the mass–to-medium residential market, with the announcement of the 4%-interest rate subsidy scheme and mortgage guarantee programme by the government in 2Q09, purchasing demand strengthened significantly. As of December 2009, the government had approved 2,016 applications under the 4%-interest rate subsidy scheme and 1,471 applications under the mortgage guarantee programme. Since then, double-digit capital value growth was observed in the mass-to-medium residential market, bringing the full-year growth to 42.5%. Indeed, capital value growth was even higher in some of the newer schemes where demand is particularly strong.

On the leasing side of the mass-to-medium market, demand increased as some expatriates relocating to lower tier properties to reflect the contracted housing budgets. In 2009, mass-to-medium residential rents rose by 5.5%.

The high-end residential sector was less benefited by the government’s newly announced incentive measures as they were mainly designed for mass residential properties. On a higher base of comparison, high-end residential capital values grew by 21.9% in 2009. The leasing sector remained subdued as the number of expatriates in Macau continued to reduce. High-end residential rents remained stable after the dramatic falls in 4Q08 and1Q09, however, the completion and handover of One Central Residences has created some pressure on rents due to the increase in leasing stock. For 2009 as a whole, rents for high-end residential properties dropped by 12.6%.

‘While there is no indication whether the government will extend the subsidy schemes upon their expiry in June 2010, we observed that local purchasing power has been strengthened due to the government’s incentive policies. The number of local buyers for residential transactions in 2009 was on the rise and we expect this trend to continue in the near future,’ remarks Jeff Wong, Jones Lang LaSalle’s Head of Residential in Macau.

Several new projects were launched in 2009, such as Celebrity Lodge, Grand Eurheight, The Residencia Macau, Verde I & II, and One Central Residences. All of them were well received by the market. For the three years to 2012, there will be a total of 7,715 residential units entering the market. However, many of the newly completed units, estimated to be around 70%, have been pre-sold during their construction period. Thus, the effective number of new units available for sale is reduced to about 2,300 units.

‘Though there are risks of interest rate hike towards 2H10, ultimate holding costs will likely remain low and banks will remain positive towards mortgage lending. The mass residential sales market may slow down a bit as buyers will become more cautious after the strong run-up in prices in 2009. However, prices will remain stable as new units available for sale will remain relatively tight in 2010. For the luxury segment, the growing interest on Macau properties among the high net worth individuals from mainland China, coupled with the high level of liquidity and a gradual economic recovery, we expect there to be further room for capital value growth in 2010,’ concludes Wong.

Office

The year of 2009 saw Macau’s office market consolidate, with companies giving a high priority to cost savings. The majority of activities were for relocations to more cost-effective spaces, with expansion requirements not notably seen.

Having suffered from a slow momentum, office capital values and rents declined by 9.5% y-o-y and 12.9% y-o-y respectively in 2009.

‘Macau’s economy is expected to see a gradual improvement in 2010 with some of the suspended projects on Cotai Strip resuming their construction works and the construction of Hong Kong-Zhuhai-Macau Bridge moving onto track. It is not surprising to see demand for office space growing in 2010. However, companies’ expansion pace is expected to be slow at this initial stage of economic recovery. To look on the brighter side, the tight office supply will continue to lend support to Macau’s office rents,’ comments Gregory Ku, Jones Lang LaSalle’s Managing Director in Macau.

Investment

The year of 2009 saw foreign investors holding a wait-and-see attitude towards investment in Macau’s property market. Instead, local investors were relatively active, with properties in the four largest investment transactions during the year being purchased by the locals, fetching a total of about HKD 1.5 billion.

‘Hopefully with the reactivation of some of the suspended construction projects on Cotai Strip and on the back of a gradual global economic recovery, Macau’s property investment market will see a healthy growth in the coming year,’ says Ku.

Posted by seemacau at 1:00 AM 1 comments